February 26, 2024

Budget 2024: Your Tax Tables and Tax Calculator

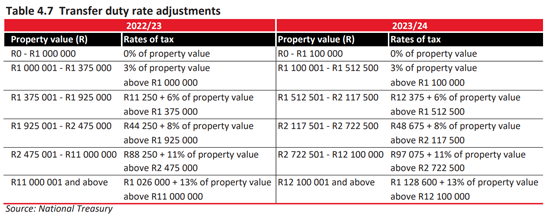

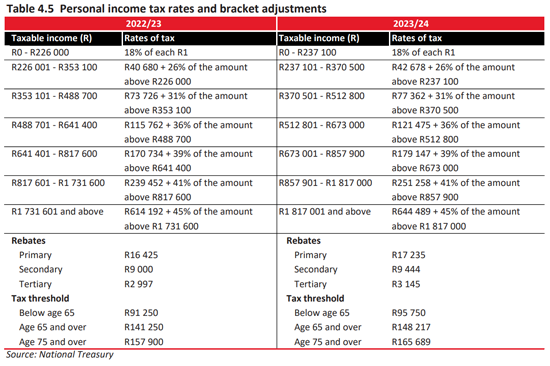

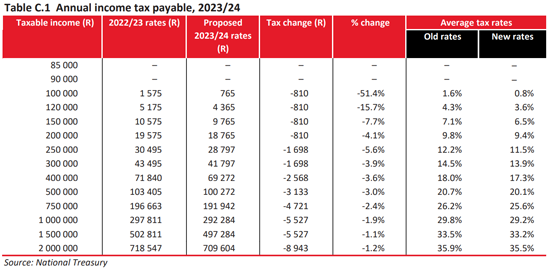

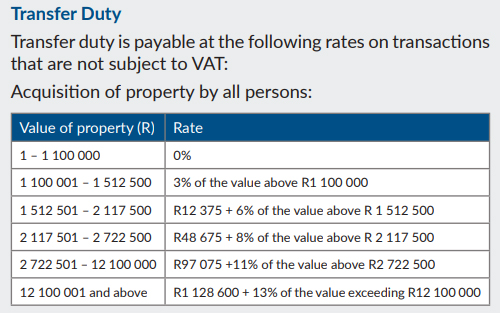

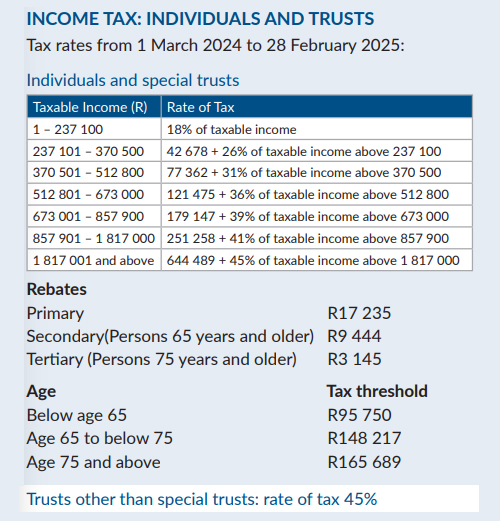

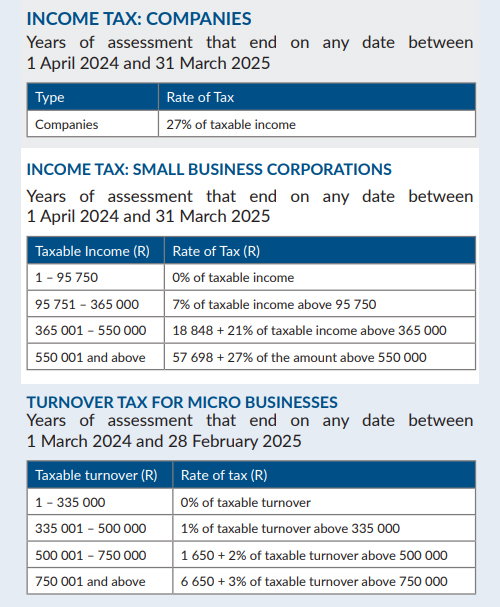

The unchanged transfer duty and tax tables, with a note on fiscal drag

Unchanged from last year, so taxpayers can breathe a sigh of relief that rates have not been increased as many forecasters had feared.

But the other side of the coin of course is that there is no inflation adjustment to the rates this year, which means that “fiscal drag” will leave you paying more tax if your inflation-linked increase pushes you into a higher tax bracket. Effectively, the buying power of your net income will fall. Plus if your property has increased in value into a higher threshold, your buyer will pay more transfer duty.

Source: SARS

Source: SARS

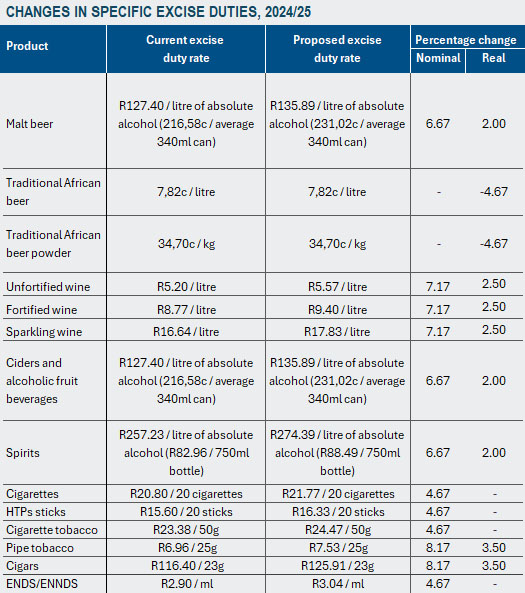

“Sin taxes” up – the details

Source: National Treasury

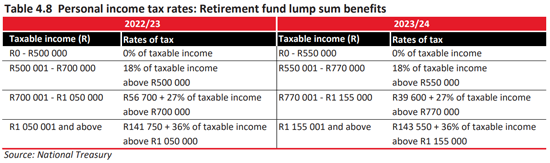

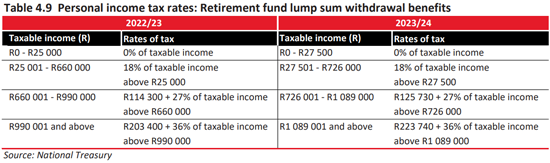

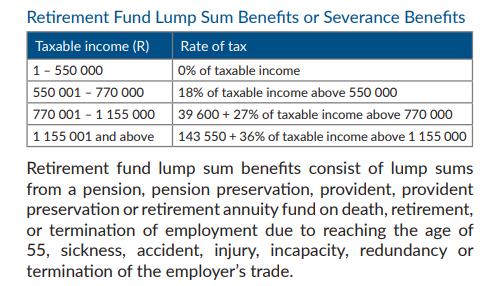

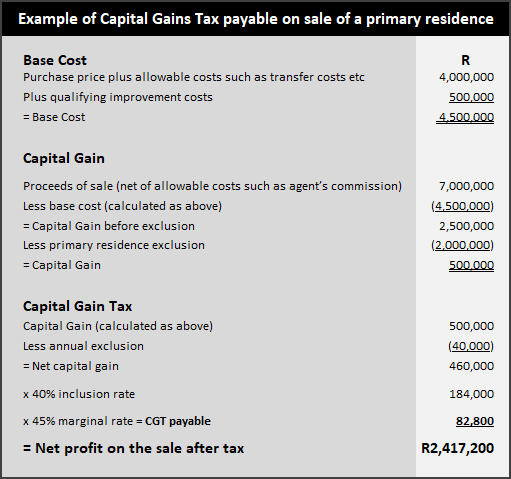

Retirement funding and the “two-pot” reform proposal

Source: SARS

Source: SARS

The proposed “two-pot” retirement reform: Per National Treasury: “Early access to retirement funds – “The two-pot retirement system will allow retirement fund members to make withdrawals from their retirement funds while they are still active members, so members need not resign to access part of their retirement benefits. … This reform is proposed to come into effect on 1 September 2024. The National Treasury aims to finalise the legislative process rapidly in the next few months to ensure that industry and regulators can prepare for implementation. Policy research and engagement continues on the outstanding auto-enrolment, mandatory enrolment and consolidation retirement reforms.”

The proposals and their tax implications are complex and subject to change, but currently provide for a one-off withdrawal of up to R30,000 on implementation, and thereafter annual “savings withdrawal benefits”.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

March 3, 2023

Budget 2023: Your Tax Tables and Tax Calculator

How much will you be paying in income tax, petrol and sin taxes? Use Fin 24’s four-step Budget Calculator here to find out.

Have a look at the tax tables below for the new tax rates and comparisons with last year’s rates –

January 3, 2023

New Year, New Business – How to Pick the Right Legal Entity for It

“Owning one’s own business is an adventure – enjoy it every step of the way.” (From the SME Toolkit article referenced below)

First, three questions to ask yourself…

If you dream of going into business for your own account in 2023, ask yourself these questions before you get started –

- Am I an entrepreneur? You have an amazing idea, you can’t wait to launch your new business, success and wealth beckon! But wait a second – are you really suited for the hurly-burly of entrepreneurship? It can be hugely rewarding, not just in the financial sense but also in terms of lifestyle and life satisfaction. But it also carries far more risk than the classic “9 to 5 employee” option, so think long and hard before choosing. There are many online quizzes to help you decide – try for example DeLuxe’s “Quiz: Are you ready to start your own business?” here.

- What’s my plan? Without a plan you sail rudderless through some very treacherous and shark-infested waters. Start-up failure rates are high, but luckily there is plenty of advice available to help you plan your course. Read for example the Business Partners “Ten Simple Rules For a Successful Start-up” on SME Toolkit.

- What legal entity should I use to trade? Don’t make the rookie mistake of setting sail in just any old boat. Starting off in the wrong entity and then having to change mid-stream will mean a lot of unnecessary expense, hassle and risk. Rather plan long term – ask yourself where you want your business to be in 5 or 10 years, how big it will be, what your exit plan will be and so on.

We set out below some brief thoughts on the various alternatives available to you, but upfront professional advice, specific to your particular needs and circumstances, is a real no-brainer here.

So, what are your choices?

…and four business vehicles to choose from

You have four main options –

- A sole proprietorship (“sole trader”). You are the business, trading for your own personal profit and loss, perhaps under a trading name such as “Syd Smith trading as ‘Syds Plumbing’”.

- A partnership of 2 to 20 individuals or entities, pooling resources to carry on a trade, business or profession for a share of the profits.

- A private company (“Pty Ltd”) with any number of shareholders. Controlled and administered by directors.

- A trust (number of trustees and beneficiaries not restricted). There are various types of trust, with trustees controlling and managing trust assets and/or trading for the benefit of beneficiaries.

Note that you might be advised to combine one or more of these entities in a corporate structure, and that there are other specialised types of entity available to, for example, non-profit organisations (charities etc), professionals (lawyers, accountants, doctors etc) and the like.

The pros and the cons of each

Have a look at the illustrative table below for a summary of the advantages and disadvantages of each of these options.

Don’t forget the tax and estate planning implications!

Each of your choices carries with it a mixed bag of positives and negatives when it comes to both tax and estate planning implications. For an overview, have a look at SARS’ “Starting a business and tax” webpage, with a link to its “Tax Guide for Small Businesses” PDF.

That Guide is 102 pages long, and unless you are comfortable with the complexities involved, professional advice specific to your circumstances is again essential.

In a nutshell –

- Estate planning: You may be advised to use companies and trusts for tax-efficient and practical transfer of wealth to future generations, as well as for asset protection from creditors both before and after you die. Both companies and trusts are “perpetual” in the sense that they survive changes in directors/trustees (resignation, removal, retirement, insolvency, death etc), with potential multi-generational savings in estate duty and avoidance of the cost and delays inherent in deceased estate administration.

- Tax efficiency: Sole traders and partners are taxed at individual rates; trusts other than special trusts at a flat rate of 45%; companies at a flat rate of 27% (27% for years of assessment ending on 31 March 2023 and later, previously 28%) with 20% dividends tax when you take profits out. There are a host of other factors to take into account here, including aspects such as Capital Gains Tax inclusion rates, exclusions, exemptions, small business breaks and the “trust conduit principle” all being highly relevant to the ultimate question – will you be better off being taxed as an individual or will some form of corporate and/or trust structure be more tax efficient for you?

Take that professional advice!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

January 3, 2023

“Double Jeopardy” for Tax Evasion – Penalties plus Prosecution

“Administrative penalties and criminal proceedings do not serve the same purpose. The [one] is aimed at strengthening internal controls of the administrative authority and to promote compliance while the other is aimed at correcting a behaviour that caused harm to the society.” (Extract from judgment below)

SARS has announced major crackdowns on tax defaulters, and a recent High Court decision highlights the dangers of being caught out for “intentional tax evasion”.

R1.3m prejudice to SARS

- A close corporation (CC) registered for both income tax and VAT (value added tax) rendered “nil” returns to SARS over a four-year period, indicating that no income had been generated and no expenses incurred.

- After a tax audit, SARS determined (and the CC admitted) that the returns were false and that SARS had in consequence suffered prejudice of R819,607 on VAT and R493,600 on Income Tax.

- SARS levied 10% late payment penalties and further imposed a 150% understatement penalty on both Income Tax and VAT. The 150% was imposed for “intentional tax evasion”.

- Both the CC and the member were then also charged criminally for intentional tax evasion.

Both penalties and prosecution – is that “Double Jeopardy”?

They applied to the High Court for a declaration that the relevant sections of the Tax Administration Act are invalid, arguing that it is inconsistent with the constitution to “criminally punish the taxpayer twice for the same criminal offence of intentional tax evasion.”

Which raised the question of whether or not this was a case of “double jeopardy” – the legal rule that “no one may be punished for the same offence twice.” You cannot, in other words, be repeatedly prosecuted for the same offence.

But, held the Court, “nothing precludes civil administrative proceedings and criminal proceedings from the single act”. Double jeopardy does not apply in a case such as this where “calling the taxpayer to account for the wrongdoing before an administrative body as well as the criminal are two distinct processes”.

In other words, both the CC and the member, having been subjected already to hefty administrative penalties (that 150% understatement penalty must hurt particularly badly!) now face criminal prosecution as well. Criminal records, substantial fines and direct imprisonment are all on the table.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

November 28, 2022

Selling Property this Festive Season: The Tax Angle

December and January have always been prime months for selling residential property in South Africa, and if you are a “Festive Season Seller”, here are two really important tips for you.

- Plan your finances

Understand and plan for all the financial implications, not just the legal ones.Prepare a cash-flow forecast so that you know what you will receive and when, and what you will have to pay and when. Your forecast will tell you what funds you must have available at all stages of the sale and transfer process, and it will answer your bottom-line question – what will be left in your pocket at the end of it all? - Don’t forget your CGT liability

There are many expenses you should provide for (ask your lawyer to help you list them), but in this article we’ll only address one of them – the CGT (Capital Gains Tax) aspect.

This is vital – if you made a “capital gain” on the sale (more on how to calculate that below) you could be liable to pay CGT. If so, it could well be a substantial liability, and not planning for it will leave you in a world of pain because if you can’t pay your tax bill SARS will be after you with a big stick (SARS has extensive powers when it comes to debt collection).

There is a bit of good news: The advantages of owning your own family home, and the value of property generally as an investment channel, will for most people outweigh the pain of having to pay tax when you eventually sell. Plus, as we shall see below, paying CGT on a property sale is not nearly as painful as it would be to pay income tax on it. Indeed, if the capital gain on your primary residence is R2m or less, your CGT bill is nil!

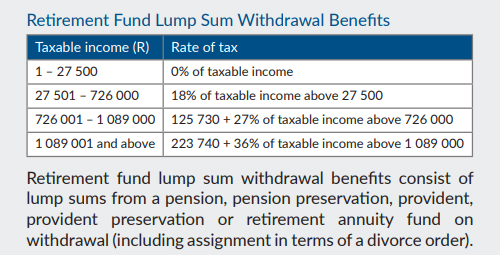

How does CGT on a property sale work?

This is a complex topic, so what follows is of necessity a summary of general principles only – there is no substitute for specific professional advice here!

- What is Capital Gains Tax? CGT forms part of your income tax and is a tax on any “capital gain” you make on an asset, in this case a property. The capital gain is the difference between your base cost and the proceeds of your sale.

- What is “base cost”? This is what your property cost you to acquire (including transfer costs, transfer duty and the like) when you bought it. Note that CGT only kicked in on 1 October 2001, so if you bought the property before then it is the property’s value at that date that you will use. Qualifying improvement costs (extensions, additions and the like but excluding maintenance or repair costs) are also added to your base cost, so keep a separate note and proof of these as you incur them over the years. Our example calculation below assumes a homeowner who bought a number of years ago for R4m inclusive of transfer costs and duty, then spent a total of R500k on improvements (perhaps adding an extra room and a swimming pool).

- How do you calculate the “sale proceeds”? From the sale price you can deduct any costs of selling which are directly related to the sale, such as agent’s commission, advertising, legal costs and so on. In our example we assume net sale proceeds of R7m.

- How do you calculate the “capital gain”? This is the difference between the base cost and the proceeds of the sale (R2.5m in our example, before the primary residence exclusion).

- What can you deduct from the capital gain? If the property is in your personal name and is your “primary residence” (i.e., where you normally live) you can deduct a R2m exclusion from the capital gain. Note that if you used your house for business purposes or if you didn’t reside in it for the whole period of ownership, you need to take specific advice on how much (if any) of the exclusion is available to you. You can also deduct an “annual exclusion” of R40,000. In our example we assume the seller is entitled to both exclusions in full, resulting in a net capital gain of R460,000.

- How are you taxed on the net capital gain? The example below will help clarify this. Your capital gain is added to your annual income tax liability at the “inclusion rate” applicable to you. Individuals and special trusts have an inclusion rate of 40%, whereas other trusts and companies have an inclusion rate of 80%. You will then pay tax on that amount at your marginal tax rate (18% – 45% depending on your taxable income). In our example we assume an individual taxpayer paying tax at the highest marginal rate of 45%, the resulting tax liability of R82,800 amounting to just under 1.2% of the net sale proceeds. Our seller’s profit on the sale net of tax would then be R2,417,200.

So how much CGT will you actually pay?

For an individual your calculation is: Capital Gains Tax = Capital Gain x 40% inclusion rate x your marginal tax rate.

Have a look at the example below which assumes an individual home seller entitled to the full R2m primary residence exclusion and paying tax at the highest marginal tax rate of 45%. Then use your own figures and make your own calculation.

(Source: Adapted from SARS examples)

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNew

May 26, 2022

Tax Freedom Day 2022: The Day We Stopped Working for Government

“Taxpayer: One who doesn’t have to pass a civil service exam to work for the government” (Anonymous)

“Tax Freedom Day” is the first day of the year on which we South Africans (we’re talking about the “average” taxpayer here) have finally earned enough to pay off SARS and to start working for ourselves.

This year the predicted date was 12 May 2022. That’s three days later than last year, and a whole calendar month later than in 1994 when we first started recording this.

That’s a depressing trend, but it’s a worldwide one and we certainly aren’t the worst-off country – Belgians for example only get to celebrate on 6 August! Certainly food for thought for anyone thinking of emigrating. Have a look at Wikipedia here for some country-by-country comparisons.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

October 7, 2021

What SARS Says About Crypto Assets and Tax

“The future of money is digital currency” (Bill Gates)

If you are thinking of buying – or have bought – any “crypto asset” such as a cryptocurrency like Bitcoin, Ethereum, Polkadot, Solana (or any of the many other crypto currencies springing up all over the place), be aware of the tax implications.

As a start, read the new SARS webpage “Crypto Assets and Tax” here, first published on 27 August 2021 and providing guidance on (at date of writing – expect this webpage to evolve!) these questions –

- What is it?

- How did we get here?

- Do I need to pay tax on crypto assets?

- How will it work? (With an example of the ITR12 Income Tax Return for the 2020/21 tax year)

- How is SARS tracing crypto asset transactions?

There are still grey areas here – and many pitfalls – so be sure to take specific professional advice!

© LawDotNews

January 15, 2020

Must You Pay Tax on Your Rental Income?

“Few of us ever test our powers of deduction, except when filling out an income tax form” (Laurence J. Peter of The Peter Principle)

Letting out property can give you an excellent “annuity” income, and if that concept appeals to you and a buy-to-let property comes your way at the right price put an offer in right now; before the current ‘buyer’s market’ runs its course.

In your financial planning however remember the tax implications, because as a landlord you must add your rental income to your salary and other taxable income in your tax return every year. Not to do so is tax evasion, and that carries heavy financial penalties as well as the very real threat of criminal prosecution.

Having to pay tax on your rental income could be make-or-break when it comes to deciding on how much you should pay for a particular property, so do your homework before you put your offer in.

Our tax laws are complex and specialised, so professional advice on your particular circumstances is essential here. These general concepts will however help you in your initial planning –

- You must declare all property rental income

You must declare your gross rental income to the taxman whatever type of accommodation you rent out – whether a whole house or apartment, just a room/garden flat or anything similar – or if you are in the guesthouse/B&B/Airbnb business. - You can claim some expenses, but not all

Your taxable income will be calculated by subtracting allowable deductions from your gross income.In general, only “expenses incurred in the production of that rental income can be claimed” (SARS). So you can claim things like levies, rates and taxes, bond interest, advertising, agent’s fees, homeowner’s insurance, garden services, electricity and water, repairs and maintenance to the leased area (which would, says SARS, “usually take place when a person attempts to restore an asset to its original condition as a result of damage or deterioration”). Beware the “beginner’s mistake” of thinking that your full bond repayment instalments are deductible – not so, only the interest portion can be claimed and not the capital repayments.In regard to VAT (per SARS): “The supply of accommodation in a dwelling is an exempt supply for VAT purposes, and consequently you may not deduct VAT incurred on expenses in respect of supplying accommodation in a dwelling.”And when it comes to renting out only a portion of a property (a room say in the house you live in) you can only claim pro-rata to total floor area. Click here for a practical example from SARS.

Take advice also on claiming depreciation on furniture and the like – your allowable deduction there might be worthwhile.

Not allowed are “expenses that are capital in nature or that are not in the production of rental income” (SARS). So the cost of improvements to the property – which would normally “result in the creation of a better asset” (SARS) – cannot be claimed. Improvements can however be added to the “base cost” of your property – important when you come to pay CGT (Capital Gains Tax) on eventual disposal.

- How are you taxed, and what about “ring-fencing”?

Your total taxable income (i.e. including net rental income) will be taxed as per current tax tables.What if your letting business shows a loss? Per SARS – “should the expenses exceed the rental income, the loss should be available for set-off against other income earned by the individual, provided that the loss is not “ring-fenced” in terms of prevailing anti-avoidance provisions”. In other words SARS could ring-fence your letting business losses to stop you from setting them off against your regular non-rental income. But if that happens you don’t lose those losses, they are just carried forward so that when your letting business starts turning a profit the losses can then be set off against that profit.Keep an eye also on your obligation to register for and pay provisional tax. As an individual if you earn taxable income of R30,000 p.a. or more in “rental from letting of fixed property” you fall into the net. - Keep full records from Day 1!

Create and maintain a full spreadsheet, with a file of supporting documents, of all income and expenditure (distinguish between revenue and capital, claimable and not claimable). It’s a relatively painless exercise if you update it regularly, but a real challenge if you end up trying to recreate everything only when the annual “income tax return panic” sets in, or when SARS and/or your accountants call for breakdowns and documentation.

© LawDotNews

June 5, 2019

Expats and Employers: Plan Now For the New Expat Tax Changes

“An income tax form is like a laundry list – either way you lose your shirt” (Comedian Fred Allen)This article is important to you if you are either a South African working abroad or an employer of one. If you don’t fall into either of those categories, but know someone who does, please think of passing this on. As an employee earning foreign remuneration (salary, leave pay, bonuses, allowances, commission etc), you currently enjoy an uncapped tax exemption (on that remuneration only, not on other foreign income) provided that you work overseas –

- For more than a total of 183 days during any 12 month period, and

- More than 60 of those days are consecutive.

Are you a “tax resident”?

Only “tax residents” are affected, so the first thing you should establish is whether you are still a tax resident or not. That’s not always easy, so take professional advice in any doubt. To illustrate some of the complexities involved, both physical emigration/relocation and “financial emigration” are different concepts to “tax emigration”. Moreover the Income Tax Act’s tests for tax residency are hardly a model of clarity – you are a “resident for tax purposes” if you are either an “ordinary resident” or a resident in terms of the “physical presence test” –- You are, says SARS, an “ordinary resident” if South Africa is the country to which you “will naturally and as a matter of course return after [your] wanderings’, your “usual or principal residence”, or your “real home”.

- Even if you aren’t an “ordinary resident”, you will still be a resident under the “physical presence test” if you are physically present in South Africa for more than –

- “91 days in total during the year of assessment under consideration; and

- 91 days in total during each of the five years of assessment preceding the year of assessment under consideration; and

- 915 days in total during those five preceding years of assessment.” Under the physical presence test however if you are outside the country for a continuous period of at least 330 days you are not regarded as a tax resident.

Should you “tax emigrate”?

If you are indeed a tax resident, don’t think of changing that status without taking full advice. “Tax emigration” and “financial emigration” are complicated processes and full of pitfalls. For example you could be entitled to foreign tax rebates or other relief on your taxable (i.e. +R1m) foreign earnings, or there may be other benefits to remaining a tax resident. So it is important to have an expert look at your specific situation and determine what is best for you overall. The big thing is to be aware that change is coming. Some long-range planning is the only way to be certain that there are no unpleasant surprises waiting to spring out on you down the line.Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews

January 17, 2019

Property Developers Beware: Deemed Accruals Can Seriously Disrupt Your Cash Flow

“Never take your eyes off the cash flow because it’s the lifeblood of business” (Richard Branson)

A recent Supreme Court of Appeal (SCA) judgment has confirmed that when a property developer enters into an agreement with a buyer to transfer the property, even if the developer only actually gets paid in a subsequent tax year, the income is deemed to have accrued to the developer at that date. The developer must therefore include the full proceeds of the sale in its income tax return for the year the agreement was signed.

This has the effect of the property developer paying tax before receiving the proceeds of the sale, putting the developer out of pocket until transfer to the purchaser takes place.

A R1.9m tax assessment challenged

A property developer in Cape Town entered into sales agreements for 25 units. Each agreement called for a deposit of R5,000 with the balance of the money to be paid on completion of the development. Purchasers could take possession once the full sale price had been secured or within 60 days of the sale. By the end of the first year 18 purchasers had taken possession and in all 25 cases the purchase price had been fully secured.

Transfer of the properties took place in the next tax year. The developer did not include the sale proceeds in his tax return for the year of concluding the agreements but showed the proceeds in the next tax year.

The Court upheld the decision by SARS to tax the developer in full in the first tax year. The assessment at just under R1.9m was based on taxable income of R6.8m.

Why the developer lost

Property developers assume a substantial risk when they undertake a development – they spend millions of Rand upfront and if they can’t sell the developed properties they make a considerable loss. They mitigate this risk by selling the properties upfront – usually before they commit to building. Clearly they will not get paid until the property is transferred, so they accept a deposit plus a guarantee (usually from the purchaser’s banker) for the balance of the selling price, or alternatively the buyer placing the funds in the conveyancer’s trust account.

Once the developer is assured of selling the properties it then proceeds with the development. On this basis, banks will advance the cost of the development to the developer.

However, in terms of the law as now confirmed by the SCA, the proceeds of the sale of the properties are deemed to have accrued to the developer and are taxable in the year the agreement is signed.

Developers need to be aware of, and plan for, the cash flow implications.

© LawDotNews