Budget 2.0: A Mixed Bag, With Good News for Property

“Good in parts” - Like the curate’s egg

Budget 2.0 presents a mixed bag for South Africans, with some welcome relief for property buyers but ongoing concerns about other proposed tax changes. Let's break down the key announcements and their potential impact.

Transfer Duty Threshold Increased

You pay no transfer duty if the property you are buying sells for less than the set threshold. The threshold wasn't increased last year, so this year’s proposed 10% increase from R1,100,000 to R1,210,000 (from 1 April) is a welcome adjustment for inflation. With all the brackets adjusted upwards by 10% as per the table below, properties at every level become that much more affordable to buyers, and by extension sellers will also benefit.

The Ongoing VAT Increase Saga

The proposal to increase VAT from 15% to 16% over two years, with a 0.5% hike planned to take effect on 1 May 2025 and the other 0.5% on 1 April 2026, has met with fierce resistance from business, consumers and trade unions – and from the opposition benches in parliament.

As to when we can expect clarity on whether government will be able to muster enough support in parliament to convert this and its other proposals into law, we are sailing in uncharted waters and only time will tell. Hold thumbs!

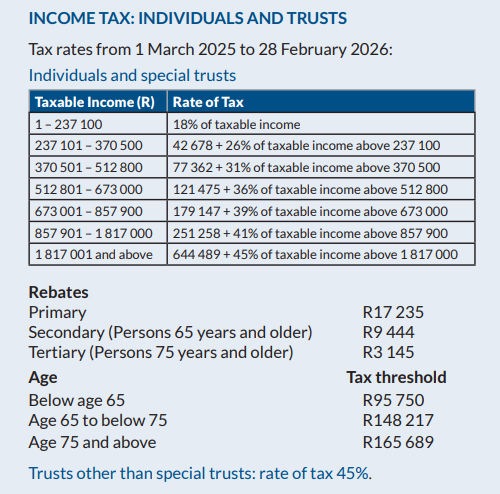

The Unchanged Tax Tables, and No New Taxes

Individual taxpayers: Your tax rates (and the associated rebates and medical tax credits) are unchanged, so we can at least be thankful that there were none of the major increases that had been hinted at. What will hurt us is that for the second consecutive year there is no inflation adjustment to the tax brackets, which means that “fiscal drag” (also referred to as “bracket creep”) will leave you paying more tax if you receive an increase – particularly if it pushes you into a higher tax bracket.

Trusts: Special trusts are by and large taxed as individuals, but other trusts are taxed at a flat rate of 45% – again unchanged from last year.

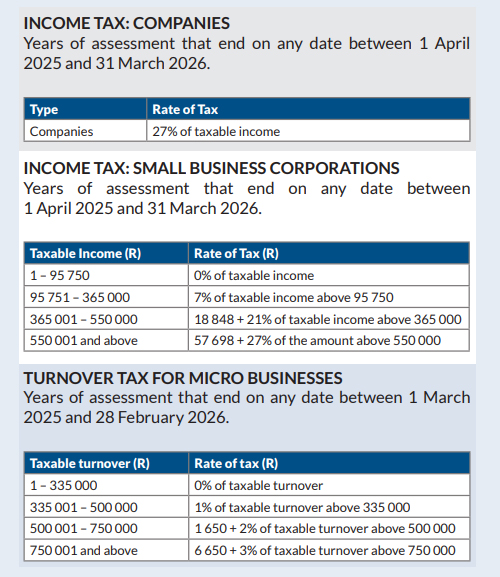

Corporate and Other Taxes

Corporate and dividend tax rates, capital gains taxes, donations tax and estate duty all remain unchanged. With all the pre-Budget speculation about possible increases in these taxes, perhaps coupled with a new wealth tax and/or new taxes to fund the NHI (National Health Insurance), this is good news.

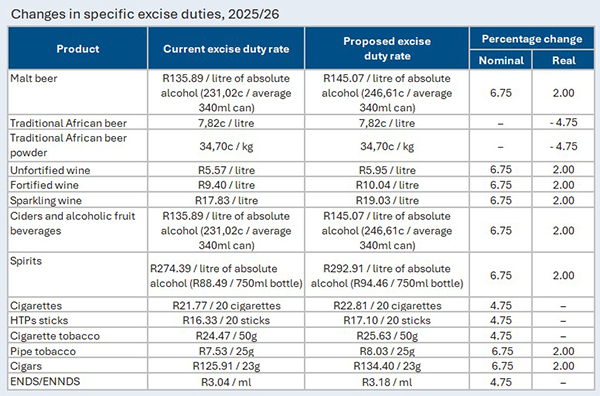

“Sin Taxes” Up – the Details

Increases in sin taxes were mostly above inflation at 6.75% for alcohol and 4.75% - 6.75% for tobacco products – see the table below for full details.

How Much Will You Be Paying?

How much will you be paying in income tax, petrol and sin taxes? Use Fin 24’s four-step Budget Calculator here to find out.

Important Disclaimer

Note: There is (at time of writing) uncertainty as to whether or not the Minister will proceed with his proposed tax changes – even if he fails to garner sufficient political support to ultimately ensure their adoption by parliament. If he does proceed, it’s equally unclear how long they will be valid for. Regardless, expect a lot of political maneuvering and perhaps some major changes in the weeks ahead!